📧 to Maria Rascon

Hi Maria,

Thank you again for staying engaged.

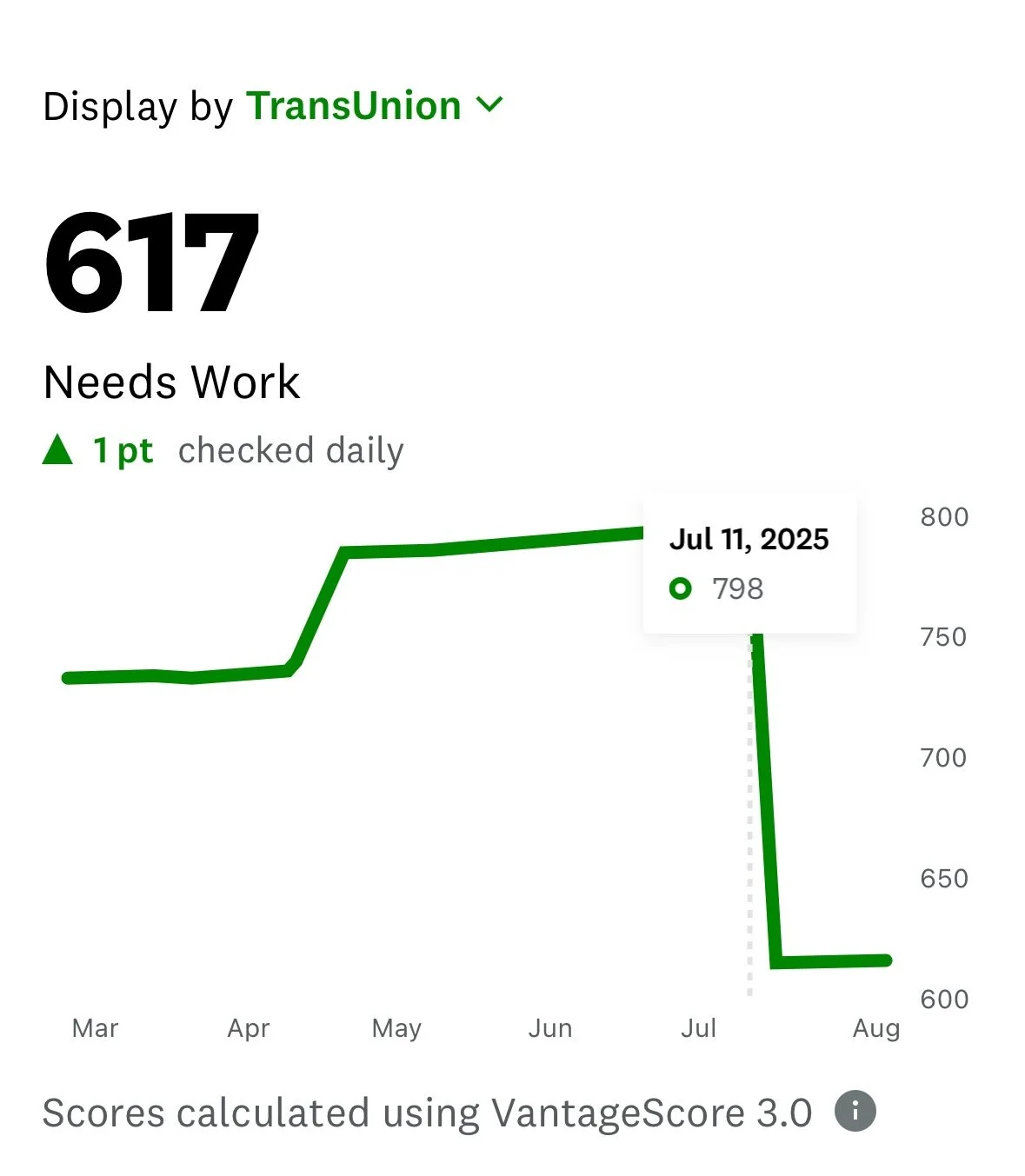

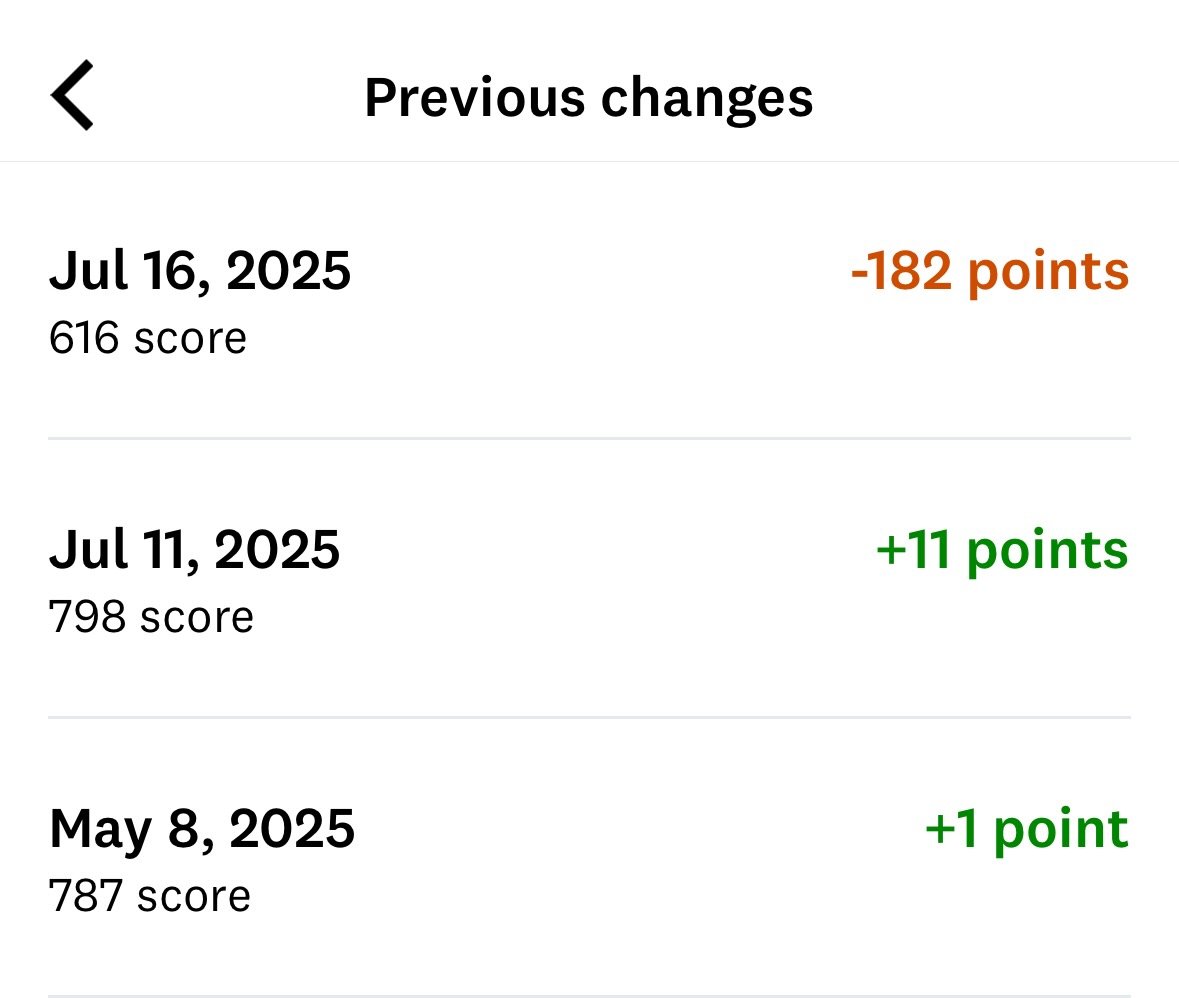

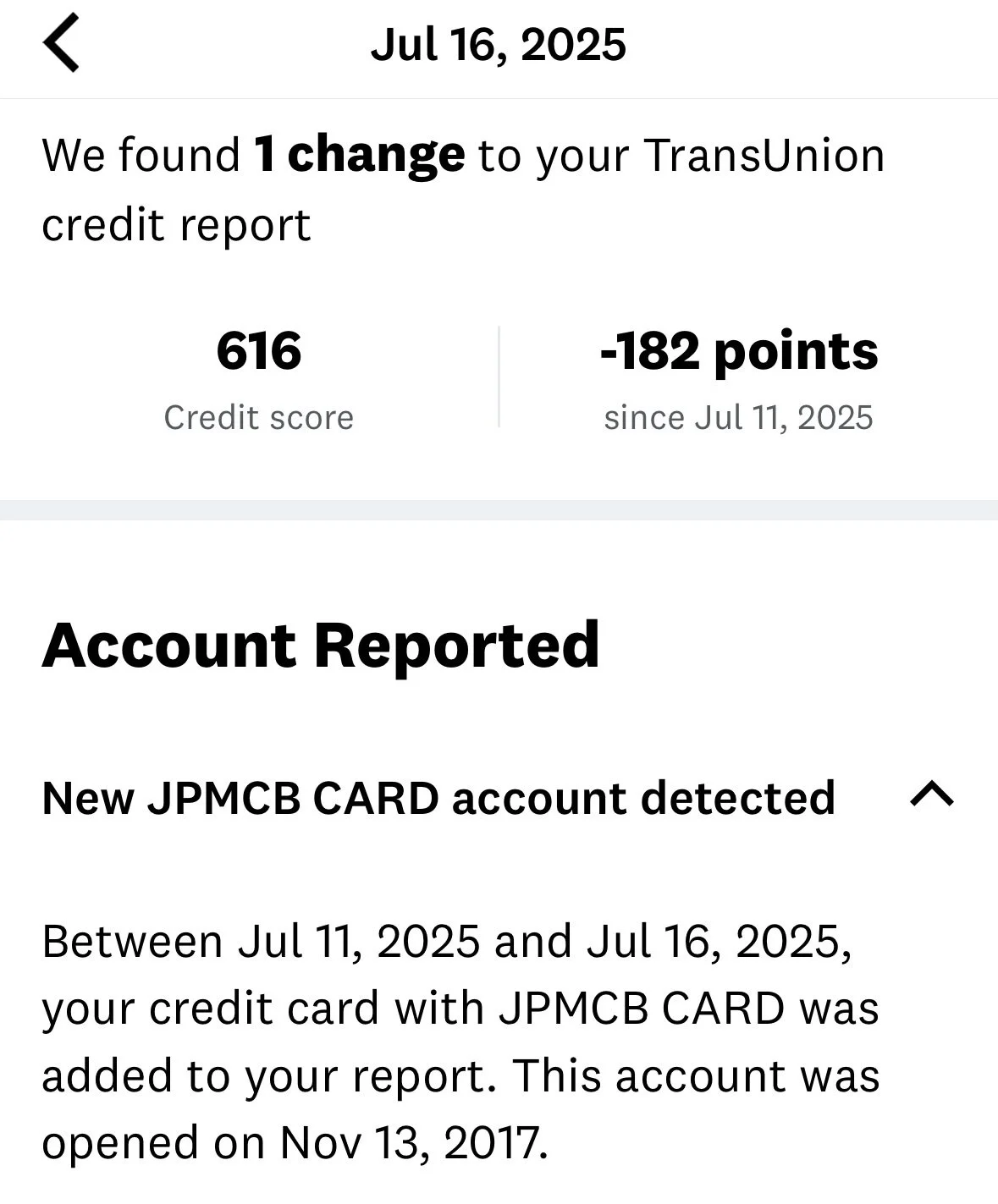

After reviewing my TransUnion file more closely, I can now confirm that Chase's reporting activity triggered a drastic drop in my personal credit score — from 798 to 616 — between July 11 and July 16, 2025. I’ve attached screenshots showing the exact dates and the associated JPMCB account entry.

This reporting appears to relate to the Labarum Limited loan. While I understand that I personally guaranteed the loan, I received no advance notice of Chase’s intent to report a delinquency to my personal credit file — either to myself or to the business. That failure, if confirmed, would likely violate both the Fair Credit Reporting Act (15 U.S.C. § 1681s-2) and Chase’s own internal credit reporting guidelines.

Before I can engage in any negotiation around the loan balance, I need Chase to do the following:

Confirm whether the reported delinquency is in error (e.g. due to system misclassification of a commercial loan);

If not in error, provide documentation of all notices sent to me or Labarum Limited prior to reporting the delinquency to TransUnion;

Take immediate steps to correct the credit report if no such notice was provided or if reporting protocols were not followed.

The impact of this report is not theoretical — it resulted in the sudden destruction of nearly 200 points from a near-perfect credit score, affecting my access to unrelated personal financial services.

I’m still hoping to resolve this constructively, but I cannot proceed until this issue is addressed. If Chase cannot correct the report or substantiate its compliance with applicable consumer protection laws, I’ll be forced to file complaints with the CFPB, SBA, and Oregon Division of Financial Regulation.

Please confirm receipt and advise how you intend to proceed.