"A Message from Chase Bank"

20250903 @ 0936

Hi Logan,

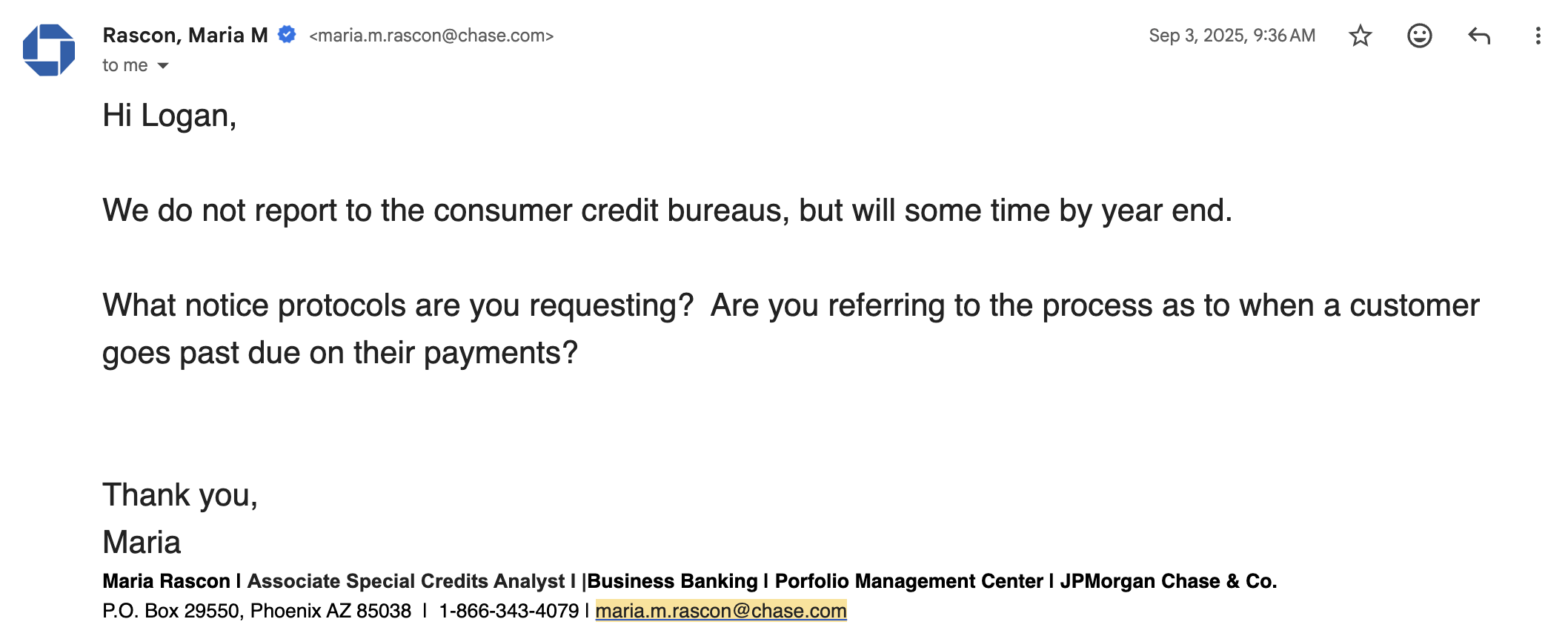

We do not report to the consumer credit bureaus, but will some time by year end.

What notice protocols are you requesting? Are you referring to the process as to when a customer goes past due on their payments?

Thank you,

Maria

20250903 @ 1126

Maria,

Your most recent reply avoids the substance of my complaint. To be clear: I have already provided the relevant timeline and evidence in my prior emails (attached again here for convenience). Chase reported a business account to my personal credit profile, years after it was opened, and only in the midst of this ongoing dispute. That action appears retaliatory and raises serious compliance concerns.

You asked “what number” I have in mind. The number is zero. I will not negotiate from a position that begins with Chase violating consumer protection norms and damaging my credit standing. If Chase believes its actions were lawful, it must provide receipts and documentation. Otherwise, I will take this matter up directly with the credit reporting agencies, federal regulators, and, if necessary, through the courts.

Please understand that my time is limited as I work to recover from the delays Chase’s actions have already imposed on my business. This is your opportunity to resolve the matter in good faith.

20250904 @ 1109

Hi Logan,

I understand your concern regarding your personal credit profile. The business loan we service in this department (account ending in 4001) is not reported to consumer credit bureaus at this time. Based on the email you sent dated August 15, 2025, it appears to be a JPMC credit card that may be impacting your bureau score. Credit card accounts are serviced by a different line of business within Chase. Unfortunately, I do not have access to details relating to credit card credit accounts or credit bureau reporting information for those accounts. Please call the number on the back of your credit cards to have any concerns addressed. I have confirmed that the installment loan referenced is not impacting your personal credit bureau score.

Regarding the installment loan:

The account is 165 days past due as of today for March, April, May, June, July and August payments. I encourage you to research the consequences of a defaulted Small Business Administration (SBA) loan. It is in your best interest to avoid SBA repurchase on this account if at all possible.

The total amount due on your account as of today is $5,871.90 (excluding late fees of $244.65) for the past due payments referenced above.

I have outlined 2 potential options to assist you below. If you intend to pursue either option to see if you can be approved, a minimum payment would need to be made today in the amount of $2,000.00. This amount would advance your due dates for March and April. It would also temporarily prevent SBA repurchase and allow some time for me to work with you to see if approval can be obtained for your preferred option.

If you do not intend to pursue possible approval for one of the options listed below, please pay the total amount due of $5871.90 to bring your account current today.

The upcoming September payment will be due on September 23, 2025 and is not included in the total amount due listed.

Potential assistance options for this loan:

If you are able to pay $2000.00 today to lower the delinquency and avoid SBA repurchase at this time, there are 2 options you can consider. Both options require business and personal financials supplied to Chase for consideration. Both options are subject to approval and not guaranteed.

Option 1: Settlement- This option would require a lump sum offer that must be paid within 30 days of settlement approval.

If you choose to pursue this option, I will provide a list of business and personal financials needed for consideration. In addition, we would need a written settlement offer from you that includes the following information:

Reason(s) you are requesting debt forgiveness

Source of funds

Settlement offer amount

The payoff on your loan as of today is $36,302.21 with a per diem of $14.15221.

Your settlement offer amount should be as close to the payoff amount as possible to increase the likelihood of approval.

No personal or business financials would be required for the settlement option if you can commit to paying 85% of the current payoff within 30 days of today.

85% of today’s payoff is $30,856.88. Although no financials would be required, we would still require a written settlement request that includes the information listed above.

If we come to an agreement on the settlement offer and the funds are paid by the deadline provided, Chase would not hold you responsible for the forgiven debt amount.

However, there could be tax implications since a 1099 could be issued for the balance forgiven. You should seek guidance from a tax consultant if this is a concern for you.

Option 2: Modification- If there is a modification product available for your loan that could lower your payment and extend your loan term:

Personal and business financials would be required for modification consideration.

If you choose to pursue this option, a list of business and personal financials are required for consideration.

If this is your preferred option, please let me know so I can make the referral to our modification team. They will reach out to you with the list of what we need.

Once all required financials are submitted, you will be notified of the decision. If approved,

Considering the severe delinquency on your account, time is of the essence. We are already in process of processing the account for SBA repurchase submission. It is important payments are made immediately to lower delinquency, avoid repurchase, and allow time for us to work with you.

20250905 @ 1317

Hi Logan,

I will work with you on your settlement review. Since this is an SBA account, we also need concurrence from the SBA on the settlement decision. Therefore, all documents received will be reviewed and submitted to the SBA by Chase on your behalf. When we receive the results of the SBA review, we will communicate to you the results and, if approved, the deadline for the lump sum payment. It is also possible that the SBA will require additional information before rendering a decision. The $2,000 payment I indicated in the previous email will need to be paid today to allow time to go through the settlement review process. Please keep in mind, the $2,000 is to advance the due dates for February and March payments owed to lower delinquency and will not be considered part of the Settlement offer amount.

The expectation is that you continue to make the required monthly payments while your settlement request is being considered. You may also want to consider the possibility that you will need to increase your settlement offer in the event the SBA will not approve your initial request. You could look into outside financing, borrowing from friends/family, etc.

In the event a settlement agreement is not reached, it is important that you have an alternate plan for resolution. We require the same financial documents for modification consideration. If you’d like, we can proceed with a dual path review (both modification and settlement) simultaneously. Please let me know immediately if you are also interested in a modification review so I know how I should proceed when your documents are submitted.

Before you start gathering financials, the SBA requires that I inform you of the following information relating to your settlement request: Acceptance of a compromise offer is considered a loss to the federal government, which may adversely impact the obligor’s ability to obtain future financing from the federal government, including another SBA loan. In addition, acceptance of a compromise offer could have tax consequences that the obligor may want to consider.

As required by the SBA, please see the 5 forms attached to this email that must all be completed, signed, dated, and returned along with the list of financial information outlined below. Once you have compiled the financials and completed the attached forms, clearly label each and attach as a separate document. Send all attachments to me in one email by 9/19/25.

Please understand that both the PFS and the Debt Schedule must have a wet signature and be dated (no electronic signatures can be accepted).

For the attached document named Debt Schedule for cash flow analysis: If there is no other “non-Chase” business debt, please indicate that information on the document.

As stated above, please separate and clearly name your documents individually so that we can expedite the process for you (IE: “2023 business tax return”, “Sept 2025 Pay stubs”).

Please do not combine multiple financial documents in 1 attachment - This will delay the process as we will need to have you separate the documents and resubmit.

Financial documents required in addition to the attached files:

Business

2023 & 2024 business tax returns with all the schedules (or the 2022 & 2023 tax return plus proof of ext. for the 2024 tax return).

2024 End of Year and Year to Date Balance Sheet. (the 2024 End of Year Balance Sheet should already be included in the 2024 tax return but will need to be sent independently if the 2024 business tax return hasn’t been filed yet)

2024 End of Year and Year to Date Profit and Loss statement (Income Statement). (the 2024 End of Year Profit & Loss Statement should already be included in the 2024 tax return but will need to be sent independently if the 2024 business tax return hasn’t been filed yet)

2 months of recent bank statements, investment statements or other documentation that evidences liquidity.

Business Debt Schedule. [Please indicate all other debts the business has on the attached form (i.e. loans, lines of credit, credit cards)]

Personal

2023 & 2024 personal tax returns with all schedules (or the 2022 & 2023 tax return plus proof of ext. for the 2024 tax return).

2024 W-2’s and 1099’s

2 months of current paystubs or a copy of your SSI Award letter (If you have not collected a paycheck from your business or are not officially on the payroll, please add 6 months of your most recent personal bank statements)

Completed Chase Personal Financial Statement (attached).

2 months recent bank statements, investment statements and other documentation that evidences liquidity.

Current housing/rent statement.

A settlement proposal letter outlining the following information. Please be as concise and thorough as possible. The more detail you include to describe your hardship situation and financial inability to pay the balance in full, the better.

Full account number.

Name of business.

Reason for settlement request.

Settlement offer amount.

Source of funds.

Earliest date funds can be paid - not to exceed 30 days from date of settlement approval.

Must be signed and dated by debtor.

If you have any questions, please feel free to contact me. If you are unable to provide any of the documents listed above, please write a separate statement with an explanation as to why are you are unable to include them. **Please make sure all relevant forms are signed and dated where indicated.**

20250905 @ 0800

Maria,

Thank you for your detailed response. However, I need to point out that this information should have been provided to me when I first began asking about restructuring in October 2024. For nearly a year, I was told—including by my business relationship manager—that I needed to fall behind in order to access relief. Following that guidance in good faith is what put me in this position.

Your message frames the delinquency as though it were entirely my fault, but the record shows that Chase withheld and misrepresented information for months. That is why I do not believe I should be charged interest or penalties for the period during which Chase failed to provide a clear path forward.

Now that I finally have a concrete number, I am willing to discuss a restructured resolution. Based on both my financial capacity and Chase’s responsibility in creating this situation, I would propose a settlement in the amount of $20,000. This would close the matter fairly, without further escalation, and allow both sides to move on.

I leave the next step in your court. Please let me know if Chase is willing to engage on this basis.

Respectfully,

Logan M. Isaac

20250910 @ 0818

Hello Logan,

Since we have not received any payments or a response to the email sent Friday, 9/5/25, we will be submitting your account to the SBA for repurchase at this time due to the severe delinquency on this account. No payment has been received on this account since February 23, 2025 and we can no longer hold the account from repurchase.

20250912 @ 1038

Maria,

I received your message regarding Chase’s intent to submit my account for SBA repurchase. I want the record to reflect several critical points:

You demand a five-day turnaround from me, yet ignored my emails for weeks at a time. It was only after the Executive Office (CCed, case number ECW250627-07428) intervened that you resumed contact. This double standard demonstrates bad faith.

The delinquency you now cite was precipitated by Chase’s own actions and guidance. As documented in earlier correspondence, I was told by Chase’s Business Relationship Manager that I would need to “fall behind” in order to access relief. When I followed that advice, Chase reversed course and used the delinquency against me.

I have already referred Chase’s handling of this SBA-guaranteed loan to the SBA Office of Inspector General for investigation of possible misconduct by a financial institution (Complaint ID 20250905q7xw)

Given the circumstances, I will not continue engaging in a one-sided process where Chase imposes arbitrary deadlines it does not apply to itself. From this point forward, I will reply only to correspondence from Carole at the Chase Executive Office, who has already been made aware of these issues.